Where Are Home Prices Heading? A Regional Look at Today’s Market

As we move into the final quarter of 2024, the U.S. housing market continues to show signs of rebalancing. With inventory climbing, pricing growth slowing, and interest rates edging downward, many buyers and sellers are reentering the conversation—and for good reason.

For those navigating probate sales, downsizing, or repositioning their assets for retirement, understanding these shifts is critical. Here’s a closer look at where home prices are rising or falling, and what the data reveals about our path forward.

Inventory Is Up—But Not Everywhere It Counts

In September 2024, the number of homes for sale rose for the seventh consecutive month across the 52 metro areas surveyed by RE/MAX, increasing 6.4% from August and a notable 33.6% over the previous year. New listings jumped 9.7% compared to September 2023—good news for buyers who have spent the last few years competing for limited options.

Yet not all inventory is created equal. In Atlanta, for example, active inventory is up 63% since January. But as Kristen Jones of RE/MAX Around Atlanta points out, supply remains thin for homes under $500,000. Sales are more robust above that threshold, suggesting that affordability—not just availability—remains the true constraint.

Pricing Plateaus and Seasonal Slowdowns

While sales volumes dipped by 13.3% from August to September—a typical seasonal trend—the median sales price fell just 1.4% to $429,000. Compared to a year ago, prices are still 4.6% higher, marking the 15th consecutive month of year-over-year price gains.

Key takeaways:

- Buyers are still paying 99% of asking price on average.

- Homes are sitting slightly longer—40 days on market in September, compared to 38 in August.

- Months of inventory increased to 2.7, up from 2.1 in September 2023.

In short, while the pace of sales has cooled, pricing remains resilient—largely because demand still outweighs supply in many regions.

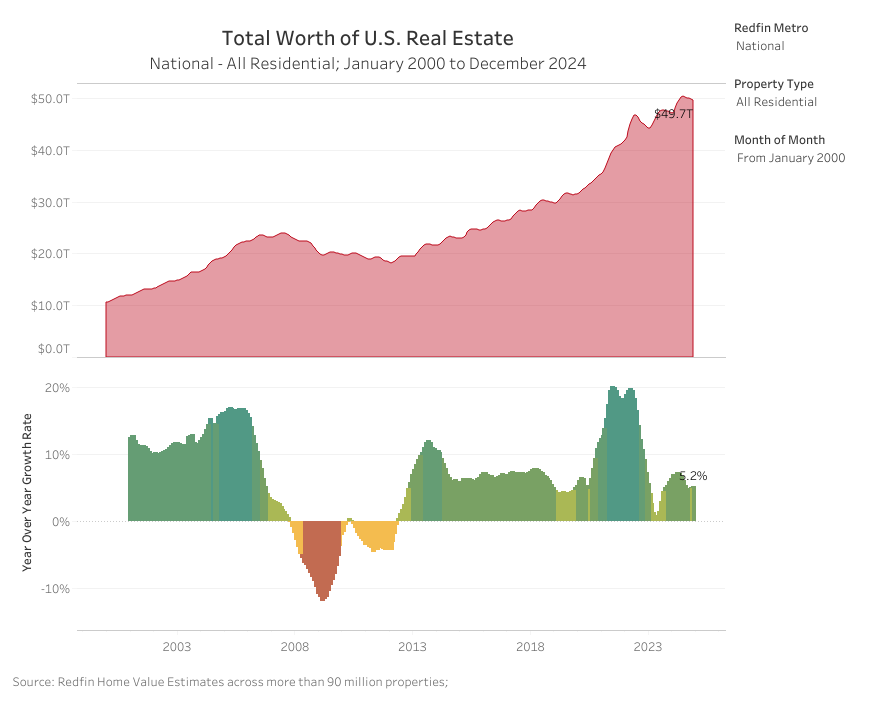

Looking Back to Look Ahead: The Long View on Market Volatility

To understand where we’re going, it helps to remember where we’ve been. The housing market has weathered major shifts over the past two decades—from the speculative highs of 2006, to the crash of 2008, to the post-pandemic surge and the affordability crisis we’re seeing now.

What’s different today? Homeowner equity. A recent analysis by the Federal Reserve shows homeowners have accumulated historic levels of equity—even as mortgage debt has grown more slowly. This creates financial flexibility for many sellers, particularly seniors looking to right-size or estate representatives managing inherited property.

However, this equity growth may come with tax implications. If your capital gains exceed $500,000 (for married couples), you could face additional liabilities. It's essential to consult with a qualified tax advisor when considering a sale.

Mortgage Rates: A Glimmer of Relief

Interest rates have begun to ease in response to Federal Reserve policy signals. By early September, the average 30-year fixed mortgage rate dropped to 6.35%, down from 7.52% in April. That reduction alone could save borrowers more than $375 per month on a standard mortgage—a significant improvement in buyer purchasing power.

Lower rates, combined with slow but steady inventory growth, could fuel renewed activity as we head into 2025.

What This Means for You

Whether you’re managing a property transfer through probate, planning a retirement move, or exploring your first purchase, the market today offers both opportunity and complexity. Here are a few practical insights:

- For sellers: If you’re holding significant equity, now may be the time to sell before competition increases. But factor in any potential tax implications and speak with a financial advisor.

- For buyers: Lock in a rate now while they’re trending down and before inventory tightens again. Builders may offer favorable terms that aren’t available in the resale market.

- For heirs and estate managers: Understanding current value and timing in your local market is essential to making smart decisions that preserve the estate’s financial health.

Sources:

https://news.remax.com/press-release/re-max-national-housing-report-for-september-2024

https://www.globalpropertyguide.com/north-america/united-states/price-history

https://www.homesforheroes.com/blog/housing-market-trends-september