By Tom Pantazis

•

December 1, 2024

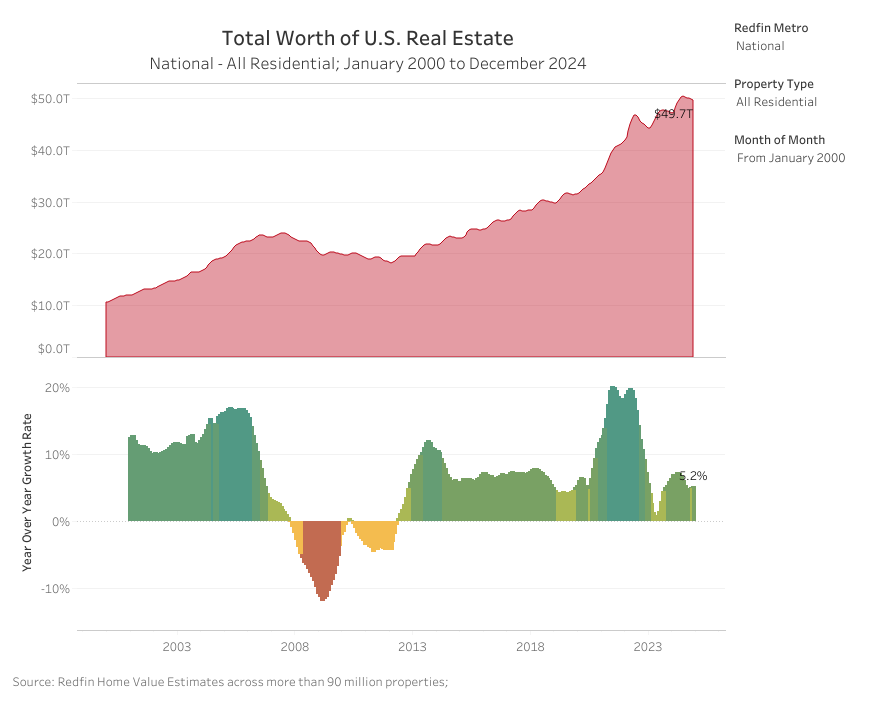

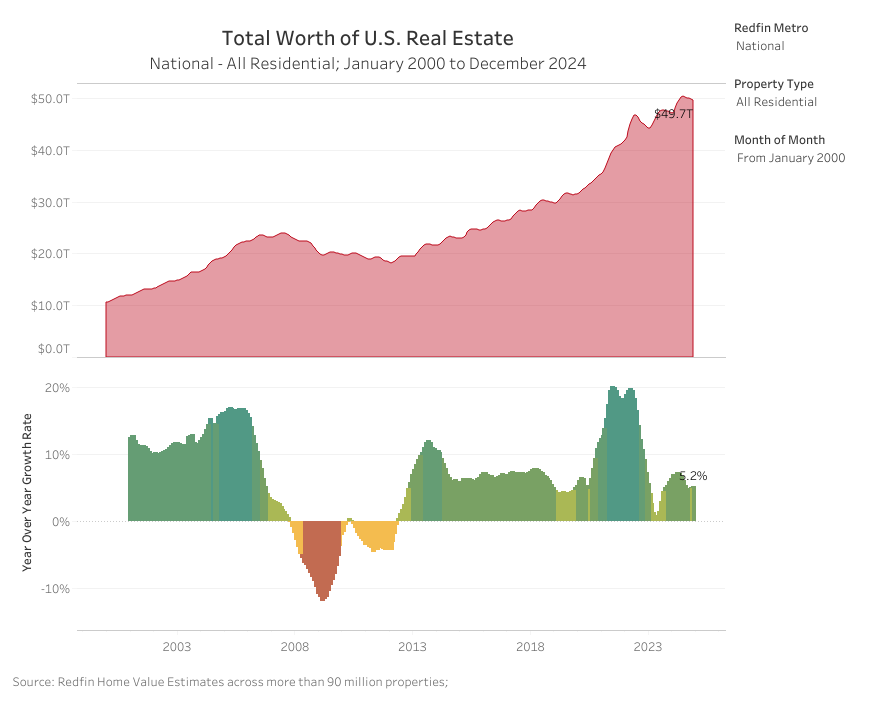

As 2024 comes to a close, we can confidently say this year reshaped more than just property values—it redefined how we think about homeownership, affordability, and long-term real estate strategy. What began with hopeful predictions for declining rates quickly became a year of volatility, innovation, and hard-earned resilience. For those of us serving clients navigating probate sales, retirement transitions, or generational wealth planning, 2024 offered both challenges and opportunities. Here’s a look back at the key forces that shaped the market—and what they might mean as we prepare for 2025. 1. Interest Rates Remained a Moving Target At the start of the year, the consensus was that mortgage rates would slowly decline, easing pressure on buyers and improving overall affordability. That didn’t happen. Rates surged in the spring, sidelining many would-be buyers and putting downward pressure on transaction volume. Even with a brief rate cut in September and another in November, mortgage rates remained elevated, hovering near 7% for much of the year. The volatility made planning difficult for both buyers and sellers, and the uncertainty filtered through every corner of the market. As Selma Hepp, Chief Economist at Cotality, noted, the bond market’s reaction to inflation concerns and federal deficit spending kept rates stubbornly high. While we saw brief moments of increased refinancing and pending sales, momentum was short-lived. What this means for 2025: A stable rate environment may not arrive until the second half of the year. Clients considering estate sales or major moves should be prepared to act decisively when rates dip, but not rely on timing the market perfectly. 2. Affordability Hit a Wall 2024 marked a new affordability ceiling. The cost of owning a home—when adjusted for inflation and income—reached its highest level in decades. And it wasn’t just about rising home prices or higher interest rates. Increased property taxes, rising insurance premiums, and inflation-related expenses have made homeownership more expensive across the board. For many of our clients—especially seniors on fixed incomes or families managing inherited property—this created a significant planning challenge. Key stat: Monthly mortgage payments today rival those during the Great Financial Crisis. Yet, because of slower wage growth, housing consumes a greater share of household income than ever before. 3. Inventory Shortages Persisted—But Showed Signs of Shifting The so-called “lock-in effect” kept many homeowners from selling. With ultra-low rates secured during previous refinancing booms, homeowners were reluctant to trade a 3% mortgage for a 7% one. But change is beginning. Life transitions—divorce, downsizing, estate settlement—brought more homes to market. In tight markets like California, we saw an uptick in new listings. In states like Texas and Florida, where construction boomed in recent years, inventory expanded more meaningfully. Takeaway: While inventory remains constrained, the logjam is beginning to loosen. This is particularly relevant for those exploring probate sales—timing and local market insights will matter more than ever in 2025. 4. Buyers Got Creative: The Rise of House Hacking and Shared Equity With traditional paths to homeownership increasingly out of reach, younger buyers turned to alternative solutions. Shared equity models, house hacking, and multi-generational buying grew in popularity. This shift wasn’t just about affordability—it was about flexibility and resourcefulness. And it wasn’t just buyers adapting; forward-thinking developers began offering duplexes and small multifamily units in response. For professionals: Expect continued demand for flexible housing options. Sellers with properties offering rental income potential may find strong interest, especially from millennial and Gen Z buyers. 5. The Market Grew in Value—But Slower Than Years Past Despite affordability concerns, the total U.S. housing market still grew by $2.5 trillion in 2024, bringing the combined value to $49.7 trillion. That’s a 5.2% year-over-year increase—modest by recent standards, but significant nonetheless. Much of this growth came from increased values in upstate New York metros like Albany and Rochester. Meanwhile, Florida—once red-hot—slowed due to climate risk, insurance hikes, and overbuilding. Notable trends this 2024: Millennials now own over 20% of the housing market, with a total value of $9.7 trillion. Rural home values grew 6.4%, outpacing urban and suburban markets for the seventh consecutive year. The number of homes worth $1 trillion or more continues to grow, with San Diego and Seattle poised to join that list in 2025. Final Thoughts 2024 wasn’t the easiest year to navigate—but it was a year of learning, growth, and strategy. For those managing estate assets, transitioning into retirement, or supporting family members through life’s changes, the real estate market continues to be a powerful tool when used with intention. My message to clients and fellow professionals alike is this: Be ready. 2025 won’t eliminate the challenges we’ve seen, but it will open doors for those who are prepared. Rates will fluctuate. Inventory will shift. And timing will matter. Whether you’re holding onto property with generational value, considering a strategic sale, or planning for the next phase of homeownership, I’m here to offer clarity, consistency, and trusted guidance—every step of the way. Let’s move forward with purpose. Sources: https://www.cotality.com/insights/articles/2024-look-back-housing-market-trends https://www.redfin.com/news/housing-market-value-december-2024/