2025 Market Outlook: Mortgage Trends and Buyer-Seller Insights

After a stretch of volatile mortgage rate hikes and shifting affordability, 2025 is ushering in a new phase for the housing market—one that favors preparedness over perfect timing.

For clients navigating probate sales, legacy planning, or retirement transitions, understanding what’s really happening with rates and demand can help bring clarity and confidence to the decision-making process. Let’s take a look at the latest market dynamics and what they mean for your next step.

Mortgage Rates Have Stabilized—But Don’t Expect Major Drops

Mortgage rates began to ease toward the end of 2023 and dipped as low as 6.2% in September. However, by early 2025, they’ve rebounded to an average of 6.84%—with experts expecting them to hover around 6.5% for much of the year.

The Mortgage Bankers Association, CoreLogic, and Freddie Mac all suggest the same thing: we’re entering a period of rate stability, not rapid decline.

Affordability Challenges Continue—But the Market Is Rebalancing

Affordability has been the market’s defining hurdle since 2022. Even with mortgage rates leveling out, inflation-driven costs, property tax hikes, and rising insurance premiums have kept the monthly cost of owning a home historically high.

In January 2025:

- Median home price: $396,900 (a record for January)

- Average 30-year fixed mortgage: 6.84%

- Share of homes selling above asking: 22.4%

Yet here’s what’s changing: inventory is growing. January marked the 15th straight month of rising listings, up 24.6% year-over-year. While still below pre-pandemic levels, this trend is a positive signal that supply is recovering.

For sellers, more inventory means more competition—so pricing and preparation matter. For buyers, this is the time to get pre-approved and ready to act when the right opportunity arises.

The Lock-In Effect Is Still Holding the Market Back

One of the biggest forces still affecting market movement is the lock-in effect. Many homeowners refinanced into 2–3% mortgage rates during the pandemic. With today’s rates hovering around 6.5–7%, many are hesitant to sell and take on higher monthly payments.

This has kept existing inventory tighter than it could be. However, builders are stepping in to fill the gap:

- 26% of builders reduced home prices in February 2025

- 59% offered incentives like mortgage rate buydowns

New construction may offer better opportunities than resale for buyers looking to stretch their budget or avoid bidding wars—especially those downsizing or relocating after an estate transition.

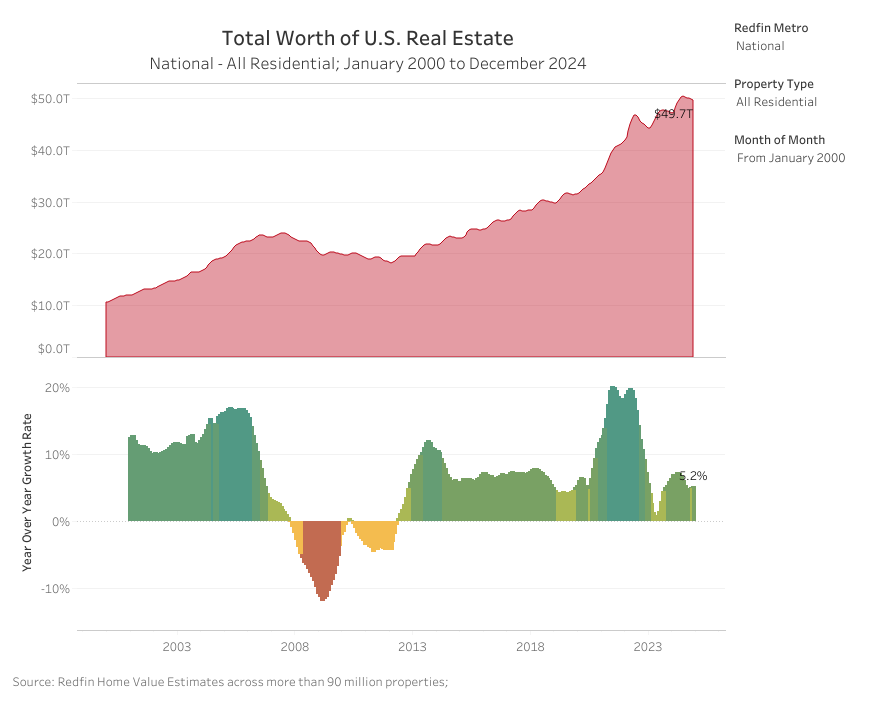

What About Home Prices? Growth Will Continue—but Slow Down

After a record-high in June 2024, home prices are expected to keep rising—but at a more modest pace. CoreLogic forecasts just 2% growth for 2025 (down from 4.5% in 2024).

In general:

- Markets with higher inventory (like Atlanta or Salt Lake City) may see minor price declines

- High-demand, low-supply metros (Miami, Boston, Denver) will continue to see appreciation

If you’re looking to sell in 2025, market strength is still on your side. But overpricing a property in today’s climate can lead to extended days on market. Smart, data-driven pricing strategies will win.

What This Means for Buyers and Sellers in 2025

For Buyers:

You may not see much price relief—but you will see more options. Competition has cooled, builders are negotiating, and rates have come down from 2023 highs. If you’re debt-free, have a solid down payment, and are buying for the long term, this is a smart year to act.

For Sellers (especially those managing estates or downsizing):

Buyer demand remains solid, especially for well-maintained, move-in-ready homes. If your property is priced appropriately and presented well, you can still sell quickly and for strong value—even in a more competitive environment.

Final Thoughts

If we’ve learned anything from the last three years, it’s this: markets change fast. Waiting for the “perfect time” to buy or sell can lead to missed opportunities—especially for families navigating probate, retirees looking to simplify, or investors evaluating legacy assets.

Instead of trying to time the market, focus on what you can control:

- Your financial readiness

- Your property’s value and positioning

- Your long-term goals

Whether you’re preparing to list, buy, or just get clarity on your options, I’m here to help you move forward with confidence, not hesitation.

Let’s talk strategy.

https://www.bankrate.com/real-estate/housing-market-2025/?utm