Climate Change and Real Estate: What Seniors and Estate Planners Need to Know in 2025

As real estate professionals, we’ve always adapted to market cycles. But the challenge emerging in 2025 is different: it’s not cyclical—it’s structural.

Climate change is no longer a distant concern for homeowners—it’s a present and growing risk with long-term implications, especially for retirees, fixed-income households, and those managing estates. Rising insurance premiums, unpredictable natural disasters, and localized value losses are changing how—and where—we buy, sell, and hold property.

Whether you’re helping a family settle an estate or advising a senior client on a downsize, it’s critical to understand how these risks are starting to reshape the market.

The Insurance Crisis Is the First Domino

Property insurance—the backbone of financing and homeownership—is now at the center of the climate-risk conversation. In states like Florida and California, premiums are skyrocketing:

- Fort Myers, FL: Home insurance premiums have doubled in just two years (from $3,200 in 2022 to $6,300 in 2024).

- California: State Farm applied for a premium increase of up to 38%, citing the need to avoid financial instability and maintain ratings.

These cost increases are not speculative—they’re directly impacting liquidity. Without affordable insurance, buyers can’t get financing. And without financing, sellers face price suppression or complete stagnation.

Insight: If you or your clients are holding property in high-risk zones, be proactive. Get current insurance quotes before listing, and plan for longer days on market and possible buyer hesitation—even if the home itself is untouched by disaster.

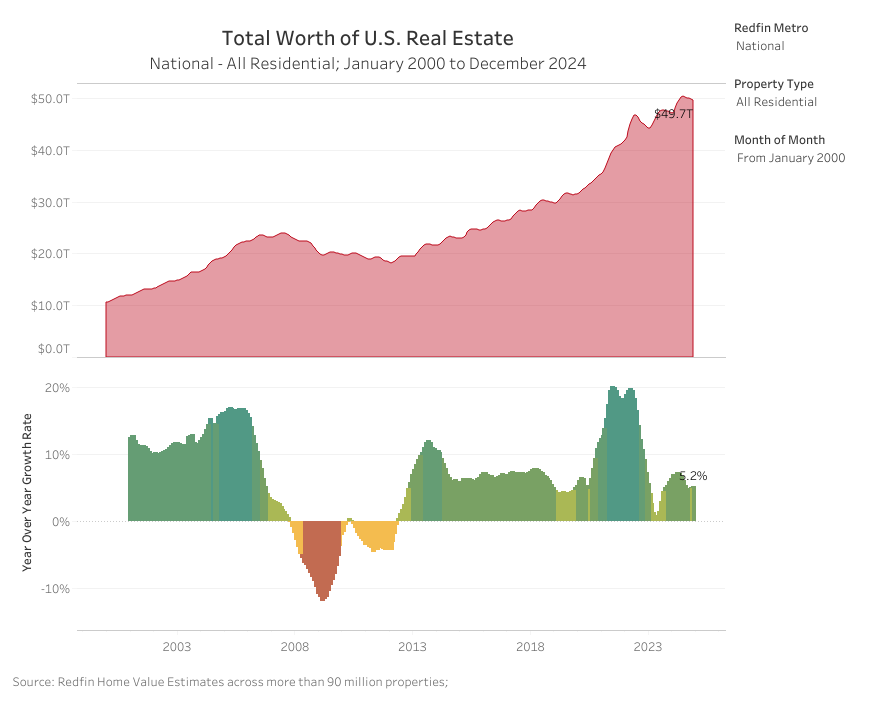

The Market Correction Has Already Begun

In parts of Southwest Florida, where back-to-back hurricanes and high flood risk dominate, home prices are correcting sharply:

- Punta Gorda, FL: Home values dropped 35% year-over-year, per Redfin.

- Some streets have 5–6 homes for sale, and very little is moving.

Why? Buyers are now calculating total cost of ownership, not just the list price. As insurance premiums climb and lenders scrutinize risk zones more carefully, the affordability picture changes—often drastically.

David Burt, the financial strategist who warned of the 2008 housing collapse (and was portrayed in The Big Short), now calls this shift “The Great Repricing.” He estimates one in five U.S. homes may face 20–40% price drops over the next five years, not because of natural disasters themselves—but due to insurance availability and affordability.

Insight: It’s time to assess your portfolio—or your clients’ portfolios—for geographic climate vulnerability. This includes homes in floodplains, wildfire-prone zones, and areas facing water scarcity.

What It Means for Seniors, Executors, and Estate Planners

For seniors living on a fixed income, and for estate executors managing the sale of inherited properties, this shift introduces real complications:

- Ongoing Insurance Costs: Seniors may be forced to sell not because of declining value, but because of rising monthly premiums.

- Estate Valuation Uncertainty: Market comparables are harder to trust in areas where value volatility is driven by external factors (like a pending insurance ruling or recent natural disaster).

- Liquidity Risk: Properties may sit longer on the market or sell for less than anticipated, particularly if buyers are struggling to secure affordable coverage.

Insight: When advising on estate planning or probate liquidation, real estate now requires a climate-adjusted lens. Insurance, location-specific risk, and buyer financing capacity all factor into timeline, pricing, and return expectations.

How to Advise Clients in 2025 and Beyond

Here’s how to help clients—especially those with senior or estate-related needs—navigate the shifting climate and insurance landscape:

1. Run Insurance Quotes Early

Before listing a home or recommending a purchase, get accurate insurance estimates. If a buyer can't finance the deal, no amount of marketing will sell the home.

2. Highlight Resilience Features

Reinforced roofs, elevated foundations, and wildfire protection can be major selling points. These features not only reduce insurance costs—they also boost buyer confidence.

3. Know the Policy Landscape

Stay informed on regional support programs. Florida and California are both introducing state-level subsidies to help homeowners retrofit and insure their properties.

4. Communicate Risk—and Opportunity

Clients need context. A 35% value drop sounds terrifying—until you realize that homes purchased post-2020 boom were often significantly overvalued. Help clients interpret these numbers realistically.

We are approaching a crossroads where climate risk and financial resilience will increasingly shape where—and how—we live. For estate executors, retirement-age sellers, and fixed-income homeowners, the pressure is already mounting in coastal and high-risk areas.

This is not cause for panic—but it is cause for planning.

As someone who specializes in estate and senior transitions, I help clients look beyond headlines and take informed, confident steps—whether that means repositioning an asset, listing a property, or reevaluating their homeownership strategy in a changing world.

Let’s talk about your goals—and how to adjust for what’s ahead.