2025 May Be the Last Year of the Inventory Shortage—Here’s What That Could Mean for Home Prices

For years, the housing market has been defined by a dramatic shortage of available homes. But that era may be coming to an end.

If current trends continue, the inventory crunch could be effectively resolved by spring 2026, with total unsold listings climbing back to “normal” levels we haven’t seen since before the pandemic. The big question is: what happens to home prices when that threshold is crossed?

Let’s take a closer look at where inventory, pricing, and buyer behavior are headed—and what that means for your next real estate move.

Inventory Is Climbing—Just Not Everywhere

Available inventory of unsold single-family homes continues to build, rising to over 640,000 in late February—a 28.7% year-over-year increase. After three years of tight supply, this expansion is a pivotal shift. However, it’s not happening evenly across the country:

California and Arizona now lead the way in inventory growth, with 45% more unsold homes than last year.

Texas and Florida, which saw sharp inventory growth in 2023, are now more stable.

The national trend points to an 18% increase in inventory by the end of 2025—a trajectory that would bring us back to 2018 levels of housing supply.

Insight: The pace and geography of inventory growth will define local markets in 2025. For sellers in high-growth areas, pricing strategy is key. For buyers, more inventory means more choices—and more negotiating power.

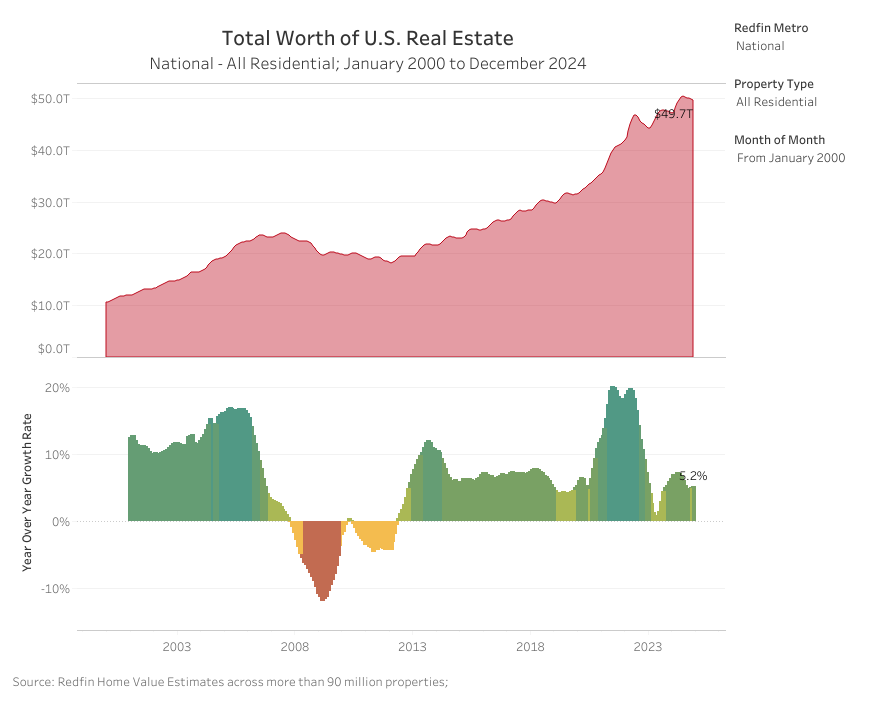

Home Prices: Rising, But Losing Momentum

While home prices are still up about 2% year-over-year, the appreciation rate is slowing. That’s a clear signal that the balance between supply and demand is shifting.

Here’s what we’re seeing:

- Median contract price in late February: $385,000

- Price growth is half of what it was in 2024 (4%)

- 33.2% of homes on the market have had price cuts—more than any February in recent years

This signals a compression effect: more listings mean sellers must appeal to a broader buyer base. Homes must be affordable to more people—not just the few who can still stretch their budgets in a high-rate environment.

Insight: For those managing an estate or looking to downsize, this is a critical moment. The window to list and sell at strong prices remains open—but only if the property is priced and marketed effectively.

Mortgage Rates Remain the Wild Card

The 6% mortgage rate continues to be a psychological and financial tipping point for buyers.

In late 2024, when rates briefly fell near 6%, demand picked up and home prices strengthened.

As of February 2025, rates have eased slightly and remain below 2024 highs—but are still hovering near 7%.

If rates drop below 6% for an extended period, we could see buyer demand rebound and inventory growth slow. If rates rise again, inventory may spike—and prices could soften.

Insight: Your timeline should guide your decision more than interest rate forecasts. We help our clients plan around their needs, not wait for the market to make the decision for them.

New Listings Remain Scarce

Despite growing inventory, new listings are still below historic norms. Only 64,000 sellers listed homes in late February—a slight increase over 2024, but still modest.

Many potential sellers remain on the sidelines, locked into ultra-low mortgage rates. This keeps supply growth gradual and prevents any kind of market “flood” from materializing.

Even in areas like Washington, D.C., where unemployment is inching up, we’ve seen no significant increase in distressed listings.

Insight: It’s important not to let fear or headlines dictate your strategy. We're monitoring these changes weekly, and as of now, there's no indication of a crash or wave of distressed properties.

Will Prices Decline in 2025?

That depends. With inventory likely to continue rising and mortgage rates still elevated, we could see flat or slightly negative price growth by year’s end—especially in rate-sensitive markets.

Historically, when mortgage rates spike—like they did in 2022—prices dip temporarily. But when rates ease, demand returns quickly. We saw this in late 2024, and we could see it again in 2025.

Insight: For sellers, the best way to protect value is by being ahead of the curve. Don’t wait for prices to peak—work with someone who understands your local market and can guide you through timing, presentation, and negotiation.

Final Thoughts

After years of imbalance, the housing market is beginning to normalize. Inventory is building. Price growth is slowing. And buyers are gaining leverage—especially if mortgage rates continue to decline.

For my clients—whether you're preparing a probate listing, transitioning out of a long-held family home, or re-entering the market after time away—the key is clarity. Understand your options, know your local market, and align your next move with your life goals—not the headlines.

If you’re wondering what 2025 means for your specific situation, let’s connect. We’ll look at the numbers, your needs, and create a plan that works.

Sources:

https://www.housingwire.com/articles/2025-could-be-the-last-year-of-inventory-shortage/

https://www.jpmorgan.com/insights/global-research/real-estate/us-housing-market-outlook