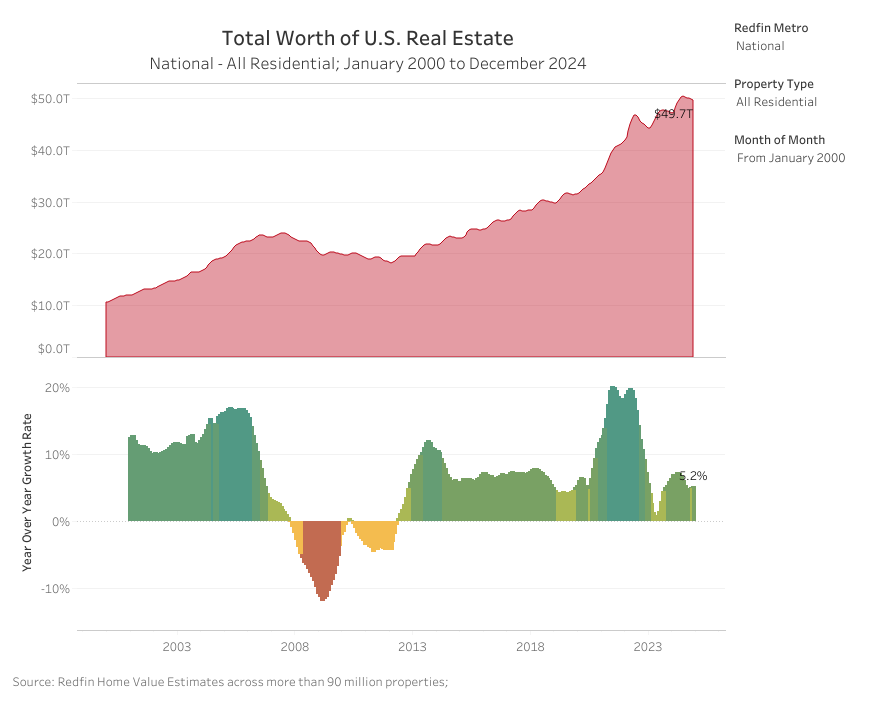

Affordability in Focus: How Rising Costs Are Reshaping Homeownership in 2025

As we enter 2025, the conversation around affordability is louder than ever—and for good reason. Homeownership remains one of the most reliable paths to long-term wealth, but rising property taxes, insurance premiums, and interest rates have complicated that path for many buyers.

Still, there are encouraging signs. Consumer confidence is growing, wage growth is improving, and new policies are beginning to reduce some financial barriers—especially for first-time buyers. Let’s break down what’s happening and what it means for buyers and sellers in today’s market.

Homebuyer Confidence Is Rebounding

Despite economic uncertainty at the end of 2024, housing sentiment has improved heading into February. According to recent surveys, 42% of buyers now believe mortgage rates will decline in 2025—up from just 31% the year prior. While only 22% say it’s a good time to buy, that number is rising from a historic low of 14% in late 2023.

What’s fueling this optimism?

- Forecasted moderation of mortgage rates

- Slower home price appreciation

- Continued wage growth

Insight: If you’ve been on the sidelines waiting for the “perfect” time, now may be the moment to refocus your strategy. Affordability remains a challenge, but market conditions are beginning to shift in the buyer’s favor.

Rising Costs Are Still a Real Factor

Affordability isn’t just about mortgage rates. In 2025, buyers are also dealing with:

- Property tax increases in fast-growing metros

- Rising insurance premiums, especially in climate-sensitive areas like Florida and parts of California

- Elevated home prices, which, while stabilizing, remain near record highs

Even with rates stabilizing near 6.5% and some relief expected later this year, monthly housing costs remain high—especially for first-time homebuyers and seniors on fixed incomes.

Tip for Buyers: Know your numbers. Understand not only your mortgage payment but also your estimated taxes, insurance, and maintenance. We help our clients map these out clearly so there are no surprises.

Why Now Could Still Be the Right Time to Buy

Spring often brings more listings—but it also brings more competition. Buying in February or March, before the market heats up, could offer key advantages:

- Less competition means fewer bidding wars and more negotiating power.

- Potential savings from winter price dips or seller incentives (especially on homes that sat through the holidays).

- More motivated sellers, who may be flexible on price or willing to cover closing costs.

Insight: For those managing estate sales or considering a downsizing move, acting now—before spring listings flood the market—can position you ahead of the curve.

Home Types Poised for Growth in 2025

Certain property types are expected to see value increases this year. If you’re buying or selling one of the following, you’re in a favorable position:

- Multifamily and ADU-equipped properties – Ideal for investors and multi-generational households

- Eco-friendly homes – Increasingly in demand among younger buyers

- Starter homes – Scarce and competitive, especially in entry-level markets

- Manufactured/modular homes – Gaining traction as affordable, customizable alternatives

Seller Tip: Highlight what sets your property apart. Buyers are looking for value, flexibility, and potential income—especially in an affordability-focused market.

Good News Ahead: Credit Score Relief May Be Coming

In March 2025, a new rule from the Consumer Financial Protection Bureau (CFPB) is expected to remove unpaid medical debt from credit reports—potentially boosting credit scores by an average of 20 points. That’s good news for buyers who may have been just shy of qualifying for competitive mortgage terms.

- Estimated impact: 15 million Americans

- Expected benefit: Up to 22,000 additional mortgage approvals annually

This shift could open the door to homeownership for many who have previously been sidelined. If you’re unsure how your credit history affects your buying power, let’s review it together.

Affordability will continue to define the 2025 housing market—but that doesn’t mean opportunity is off the table. With inventory gradually improving and mortgage rates showing signs of moderation, buyers and sellers alike can benefit from being informed and prepared.

If you’re navigating a transition—whether it’s settling an estate, helping a parent downsize, or preparing for your next chapter—I’m here to guide you through it.

Together, we’ll build a plan that works in this market—not in theory, but in reality.

Source:

https://rwmloans.com/february-2025-changes-to-help-finances/