The Lock-In Effect: How Mortgage Rates Are Reshaping the Housing Market

As we look toward the end of 2024, the U.S. housing market is being defined not by lack of interest, but by lack of movement. One of the primary forces behind this stagnation? The lock-in effect—a powerful dynamic that’s reshaping inventory, pricing, and buying behavior.

If you’re navigating a major life transition—whether settling an estate, downsizing in retirement, or making a long-term real estate decision—understanding this trend is essential.

What Is the Lock-In Effect?

Unlike locking in a mortgage rate when buying a home, the “lock-in effect” refers to homeowners who are choosing not to sell because they already have low mortgage rates. With rates rising over the past two years, many homeowners are sitting tight—even if they’ve built up significant equity.

According to Redfin, 85% of mortgage holders in the U.S. have an interest rate under 6%. Some refinanced into rates as low as 2.75% during the pandemic. When faced with today’s average rates—hovering just above 6%—selling means taking on a higher monthly payment for the same or even smaller home.

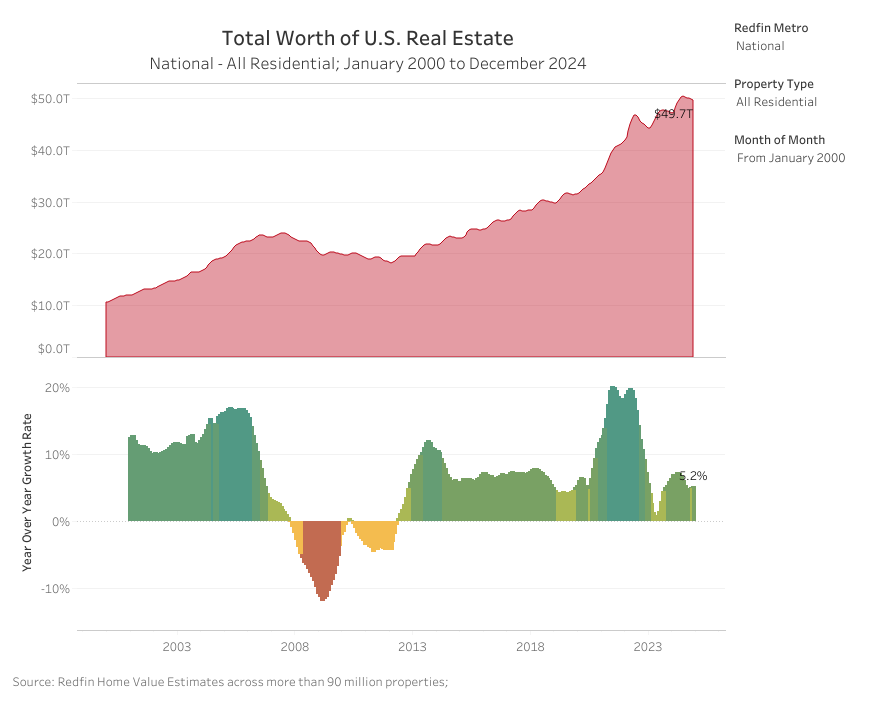

A Historical Trend with Modern Impact

The lock-in effect isn’t new. In the 1980s, interest rates skyrocketed past 17%, prompting many homeowners to stay put rather than risk higher borrowing costs. Similarly, Proposition 13 in California discouraged mobility by capping property tax increases, effectively incentivizing long-term stays in one place.

Today’s version of the lock-in effect has become a defining feature of the market—suppressing inventory and keeping prices elevated despite softening demand. As a result, new listings have dropped nearly 19% year-over-year, and many buyers are finding themselves with fewer options and stiffer competition.

How This Impacts You as a Buyer or Seller

For Sellers (Especially Seniors or Estate Representatives):

You may be holding onto a low mortgage, but if you’re sitting on equity—and planning a transition—you could be in a prime position. With inventory constrained and buyers still active, you may still attract competitive offers, particularly in sought-after price bands. However, strategic timing and pricing are key.

For Buyers:

Inventory remains tight, but there’s a silver lining. As mortgage rates gradually ease, more homeowners may be incentivized to sell, opening up new opportunities in early 2025. Until then, focus on preparedness—check your credit, gather documentation, and work with a professional to watch for favorable buying conditions.

Market Resilience Amid Affordability Pressures

Despite the lock-in effect, demand hasn’t disappeared. Millennials and Gen Z—now in their prime home-buying years—continue to fuel long-term demand. Builders are responding, with new single-family home sales rising 6.3% year-over-year in September 2024, according to U.S. Census Bureau data.

Homebuilders are also adapting by:

- Constructing smaller, more affordable homes.

- Offering mortgage rate buydowns.

- Targeting first-time buyers with tailored incentives.

Meanwhile, existing-home sales remain subdued. In September, the pace dropped to 3.84 million units (SAAR), the lowest since 2010. Yet, home prices continue to rise—up 4.5% year-over-year—as supply remains tight.

Economic Indicators: A Mixed But Hopeful Outlook

The broader economy continues to show signs of strength. GDP growth was revised up to 2.3% annually, job growth is resilient, and inflation is gradually moderating. The Federal Reserve’s recent 0.5-point rate cut indicates a softening monetary policy—a move that could unlock the market in the coming quarters.

Mortgage rates fell to a two-year low of 6.08% in late September, giving a modest boost to affordability. Refinancing activity has also picked up, particularly for those seeking to reposition assets, access equity, or consolidate debt.

First-Time Buyers Face a Trio of Challenges

While demand remains strong, future homebuyers—especially first-timers—are grappling with:

- Affordability: Despite falling rates, entry-level homes are still priced out of reach for many.

- Low Supply: Years of underbuilding have created a persistent gap in inventory.

- Economic Uncertainty: Rising unemployment, particularly among renters, could dampen activity in early 2025.

Still, the longer-term outlook remains optimistic as rates slowly decline and new construction continues to grow.

What This Means for You

In this environment, timing and clarity are everything. Whether you're preparing to list an estate property, considering a retirement move, or entering the market as a first-time buyer, here are a few key takeaways:

- Stay informed. Market conditions are changing fast. Rate trends, builder activity, and inventory levels all play a role in the right time to act.

- Plan ahead. Take advantage of periods of reduced competition to prepare financing and improve credit profiles.

- Work with a specialist. Real estate decisions connected to probate, senior transitions, or long-term planning require more than just market knowledge—they require a steady hand and experienced guidance.

Sources:

https://www.freddiemac.com/research/forecast/20241018-us-economy-remains-strong

https://www.experian.com/blogs/ask-experian/what-is-lock-in-effect