Navigating the Fall Market: How to Move Forward in a Time of Rising Inventory and Rate Volatility

As we near the end of 2024, the real estate landscape continues to evolve—marked by shifting mortgage rates, cooling buyer activity, and rising housing inventory. While headlines may suggest uncertainty, those of us who’ve weathered multiple cycles know that within every shift lies opportunity. Whether you're an estate executor trying to navigate a property sale or a senior exploring your next chapter, this fall market offers important insights—and strategic moments to act.

Let’s break down what’s happening and what it means for you.

Inventory Is Up—But the Market Is Still Tight Where It Counts

The number of homes for sale jumped by 26.2% in November 2024—the 13th straight month of year-over-year growth, according to Realtor.com. This marks the highest inventory level since December 2019. Even pending listings (homes under contract but not yet sold) rose by 14.7% year-over-year.

But before we call this a buyer’s market, here’s the nuance: new listings only edged up 2% year-over-year, a slowdown from October’s 4.9% gain. The recent surge in mortgage rates has tempered seller enthusiasm, and many homeowners remain hesitant to list due to the “lock-in effect.”

In short: while inventory is improving, the pace is uneven—especially in price ranges below $500,000. For sellers looking to capitalize on equity gains, this is still a market with leverage, especially for well-positioned, well-priced homes.

Pricing Trends: Stability, Not Slumps

The national median listing price dipped slightly year-over-year to $416,880—a modest 0.7% decrease. However, median price per square foot rose 1.6%, signaling a shift in available inventory toward smaller, more affordable homes.

Homes are also spending more time on the market—62 days on average, the slowest November pace in five years. Still, fewer sellers are cutting prices compared to last year, with just 16.7% reducing their asking price (down from 18%).

For estate sales and probate properties, this data reinforces the importance of competitive pricing and professional presentation. Properties priced appropriately for their local market are still moving—especially when aligned with buyer demand for lower square footage and affordability.

Mortgage Rates and Market Momentum: The Push and Pull

The Federal Reserve reduced the federal funds rate by 25 basis points in November, now sitting between 4.5%–4.75%. However, mortgage rates remain elevated, with 30-year fixed rates hovering around 6.7%. As history reminds us, long-term rates like mortgages don’t always follow the Fed’s lead.

This disconnect is keeping some buyers on the sidelines—and suppressing new seller activity. That said, our 2025 forecast suggests that as rates begin to ease and homeowners feel less locked-in, we could see a modest 1.5% increase in home sales next year.

For those preparing for a sale, now is the time to start laying groundwork—gathering documentation, understanding your property’s valuation, and evaluating timelines. Acting early gives you flexibility and greater control in a potentially shifting environment.

Regional Trends and Construction Activity: A Mixed Bag

Existing home sales saw a flicker of life in October, rising 3.4% from the prior month. Most of that demand came from regions like the Midwest and Northeast, where price growth has been more stable.

On the flip side, new home sales fell 17.3% month-over-month as affordability challenges intensified. Builders are tapping the brakes, with single-family starts down nearly 7%. Yet, builder confidence is creeping upward—encouraged by signs of easing inflation and a possible rate decline in 2025.

In high-demand areas, especially those with growing senior populations or estate transition activity, expect continued demand for smaller, turnkey homes—a growing niche where opportunity lies for sellers and downsizers alike.

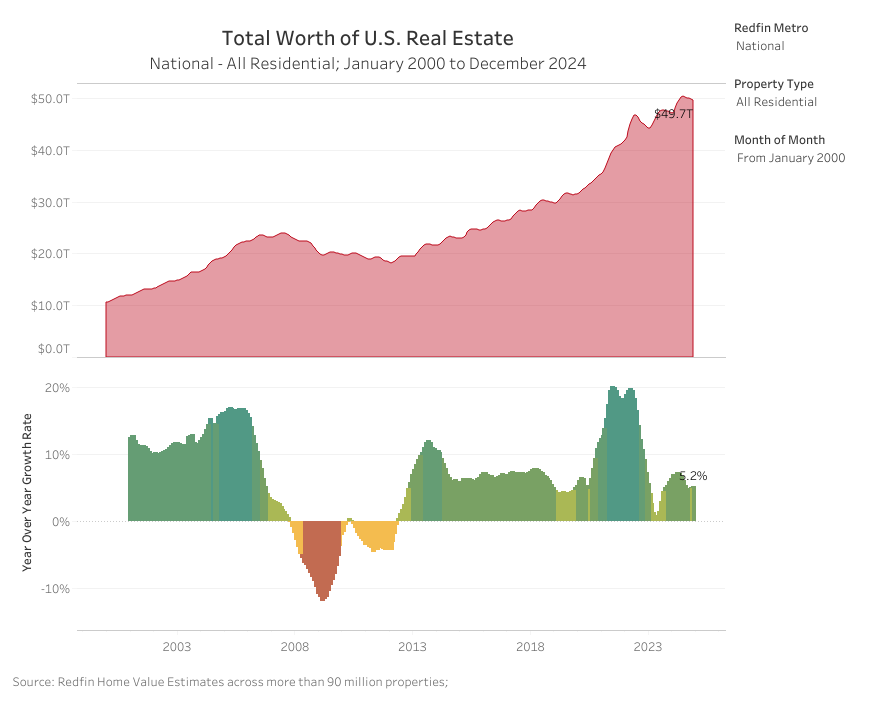

The Big Picture: Persistent Shortages, Long-Term Strength

Despite month-to-month fluctuations, the long-term reality remains: the U.S. is still short, approximately 3.7 million housing units. Supply remains particularly tight in the single-family segment, which continues to drive up prices and stretch affordability.

For first-time buyers and younger households, the challenge is real. For seniors looking to downsize or estate representatives managing a sale, this also presents a window—well-maintained homes in established neighborhoods remain in high demand, especially as rental costs rise and buyers seek stability.

Final Thoughts

Markets shift, headlines change—but smart planning always wins. In this season of transition, my advice is simple: don’t wait for perfect conditions.

Instead, prepare for the right moment. Whether you’re selling a long-held family home, helping a loved one manage a property in probate, or looking to reposition for retirement, the time to strategize is now.

This fall may not offer the same frenzy as past years, but it provides clarity, space, and opportunity. Let’s use it to your advantage.

If you’re ready to talk through your goals—or you simply want a grounded perspective on what’s next—I’m here to help.

Sources:

https://www.realtor.com/research/november-2024-data

https://www.mckissock.com/blog/appraisal/november-2024-real-estate-market-update