Mortgage Rates: Past, Present, and Future Outlook

If you're planning to buy a home this year, you're probably paying close attention to mortgage rates. Mortgage rates impact what you can afford when you take out a home loan, and affordability is a challenge today. So it's important to understand where mortgage rates have been historically, where they are now, and where they might go in the future.

The History of Mortgage Rates

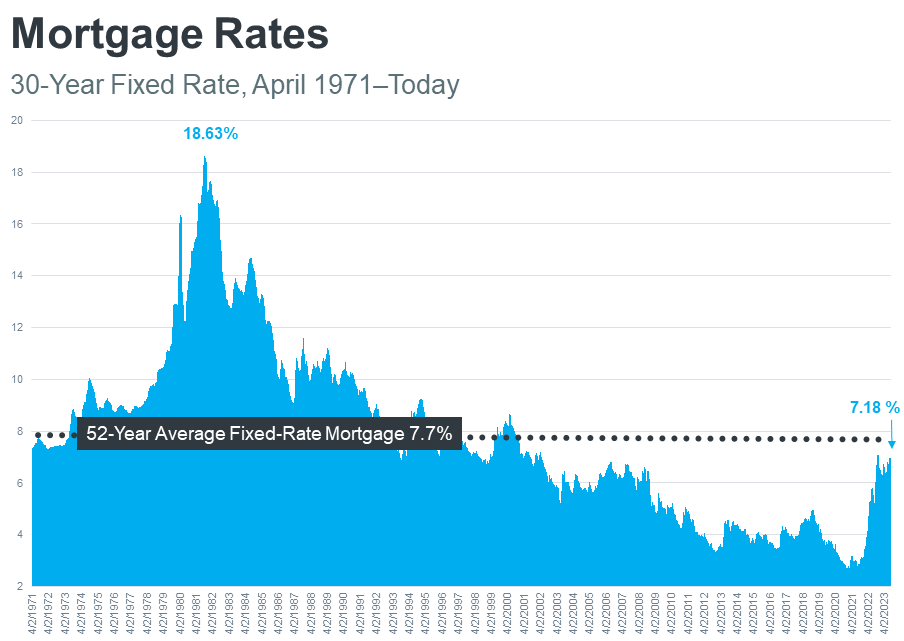

Freddie Mac has been tracking the 30-year fixed mortgage rate since April of 1971. The graph below shows the historical trend of mortgage rates since then.

As you can see, mortgage rates have fluctuated significantly over the past 50 years. They were as high as 18% in the early 1980s and as low as 3% in the early 2000s. However, they have been relatively low in recent years, hovering around 3% to 5%.

The Recent Increase in Mortgage Rates

Mortgage rates have been on the rise since the start of 2022. This is due to a number of factors, including:

The Federal Reserve raising interest rates in an effort to combat inflation.

The rising cost of materials and labor, which is making it more expensive to build homes.

The strong demand for homes, which is driving up prices.

As a result of these factors, mortgage rates are now at their highest level in over a decade.

Where Mortgage Rates Might Go in the Future

It's difficult to predict where mortgage rates will go in the future. However, the historical relationship between mortgage rates and inflation suggests that mortgage rates could decline if inflation starts to moderate.

The graph below shows the relationship between mortgage rates and inflation over the past 50 years.

As you can see, there is a clear correlation between the two variables. When inflation rises, mortgage rates tend to follow suit. And when inflation falls, mortgage rates tend to decline.

So, if inflation starts to moderate in the coming months, it's possible that mortgage rates could also decline. However, it's important to remember that the future is uncertain, and there are many factors that could affect mortgage rates.

Bottom Line

The bottom line is that mortgage rates are likely to remain elevated for the foreseeable future. However, if inflation starts to moderate, there is a chance that mortgage rates could decline. If you're planning to buy a home, it's important to stay up-to-date on the latest mortgage rates and be prepared to act quickly if rates start to fall.